Have your say on rents

If you are an Ore Valley Housing Association tenant you will receive a letter in the post explaining the proposed rent increase and a questionnaire to fill out and return to us.

This consultation is your opportunity to tell us what you think. Please make sure you respond by Monday 10th February 2020, so that our Board can hear what you have to say before they make their final decision. All comments will receive a reply and all returned forms will be entered in to a prize draw.

What is happening?

We are currently looking at our budgets for 2020-21 and are now consulting tenants about our proposal to increase rents from 1st April 2020.

Why do you increase the rents every year?

This is a comment we often hear together with the following comments that have been made by tenants when we have asked about rents in the past:

‘Every year it goes up and wages stay the same’

‘Very expensive compared to the Council’

‘Expensive for what we get, not enough home improvements’

No one wants to see their cost of living increase, however many of the costs which are a necessary part of delivering and improving our services continue to rise and we need to make sure that we have enough income to cover our costs while still making sure that our rents are affordable.

The Consumer Price Index (CPI) figure published for November 2019 was 1.5%. We know that our costs are continuing to increase each year and we estimate that our overall costs will continue to increase by more than 1.5%.

Our overall budget for planned improvements is £276k and we know that we need to carry out the following improvements during 2020/21.

- Replace or upgrade all our smoke alarm and heat detection systems by February 2021

- Install 61 x new kitchens by March 2021

At the same time we will also need to continue carrying out repairs and maintenance to our homes including regular planned painterwork programs and safety checks for gas and electric installations.

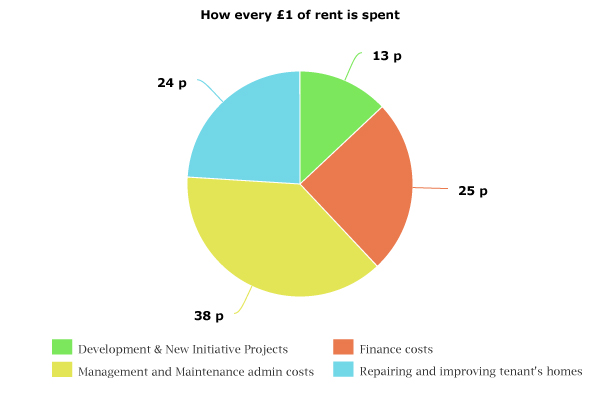

Where your rent goes.

Our aim is always to strike a balance between providing you with the level of service and standard of home you expect, while still controlling our costs to make sure that your rent is good value for money.

Why are Ore Valley rents higher than Fife Council?

Housing Association rents are higher on average than Council rents. This is because we are funded in different ways. Ore Valley Housing Association have loans which are secured against our properties, including some of the properties that were transferred to us from Scottish Homes, and we are now repaying these loans at favourable interest rates. Other than grants for building new homes and some financial assistance with medical adaptations rent money is our only income.

Local Authorities like Fife Council are funded differently. They have a large number of properties with no secured loans and use rental income from their houses, together with income from the investment of their Housing Revenue Account (HRA) to manage, maintain, repair and improve their homes. They also use this money to repay any additional borrowing that they take to fund capital expenditure on new or existing homes.

How do your rents compare with others?

We check our rents with the other Housing Association landlords in Fife. The following tables shows how our rents compare with others.

2018/19 - Average Weekly Rents

| Property Size | Ore Valley Housing Association |

Kingdom Housing Association |

Fife Housing Group | Glen Housing Association |

| 1 bedroom | £69.77 | £72.70 | £70.59 | £65.61 |

| 2 bedroom | £81.52 | £79.78 | £83.35 | £78.34 |

| 3 bedroom | £89.10 | £91.79 | £95.55 | £85.42 |

| 4 bedroom | £96.29 | £95.37 | £108.35 | £93.99 |

Your rent . . . your say . . .

Option A: This increase will see our annual income increase by £40k.

This will allow us to maintain frontline services but we will need to make extra savings by slowing down our planned investment programme.

| Option A | 1.5% | Proposed Increase | Proposed Rent |

| Flat | 1 bedroom 2 bedroom |

£1.06 per week £1.21 per week |

£72.14 per week £81.32 per week |

| Bungalow | 1 bedroom 2 bedroom |

£1.11 per week £1.25 per week |

£73.66 per week £83.95 per week |

| House | 2 bedroom 3 bedroom 4 bedroom |

£1.28 per week £1.38 per week £1.50 per week |

£86.57 per week £93.13 per week £101.00 per week |

Option B: This increase will see our annual income increase by £70k.

This is our recommended option as this will allow us to maintain frontline services and continue with our planned investment programme.

| Option B | 2.5% | Proposed Increase | Proposed Rent |

| Flat | 1 bedroom 2 bedroom |

£1.78 per week £2.00 per week |

£72.85 per week £82.13 per week |

| Bungalow | 1 bedroom 2 bedroom |

£1.85 per week £2.07 per week |

£75.50 per week £84.78 per week |

| House | 2 bedroom 3 bedroom 4 bedroom |

£2.14 per week £2.30 per week £2.49 per week |

£87.42 per week £94.05 per week £102.00 per week |

Option C: This increase will see our annual income increase by £99k.

This will allow us to maintain frontline services and we will be able to bring forward our planned investment programme. For example replacement roofs, windows and boundary fences.

| Option C | 3.5% | Proposed Increase | Proposed Rent |

| Flat | 1 bedroom 2 bedroom |

£2.49 per week £2.80 per week |

£73.56 per week £82.93 per week |

| Bungalow | 1 bedroom 2 bedroom |

£2.58 per week £2.90 per week |

£76.24 per week £85.60 per week |

| House | 2 bedroom 3 bedroom 4 bedroom |

£2.99 per week £3.22 per week £3.49 per week |

£88.28 per week £94.97 per week £102.99 per week |

What is an affordable rent?

An affordable rent is considered to be between 25-30% of your net income. In most cases we anticipate that even with a 3.5% increase most of our tenants will still be paying no more than 25% of their net income on rent.

We have tested the 3.5% increase option using a rent affordability measure based on average moderate household incomes. The moderate income data we have used is based on the lower 30% of wages in the Fife local authority area weighted by household size. Using this measure we estimate that a single person household will need to spend between 25-30% of their net income on rent if they live in one of our 1 or 2 bedroom flats and just over 30% if they live in a 2 bedroom house.

The only other households who fall into the 25-30% category are single pensioners who are paying rent for a 2 bedroom property.

TIP - most household sizes should be paying below 25% of their net income on rent. If you think you are paying more, please let us know because we may be able to help you claim additional benefits to increase your overall household income.

Useful Information for single pensioners.

State pensions are set to rise by 3.9% from next April. This means that those receiving the old state pension (ie, those who reached state pension age by April 6 2016) will see their basic payment increase by £5.05 a week to £134.25. Those receiving the new state pension (those who reached state pension age after April 6 2016) will see an increase of £6.60 a week to £175.20. State pensions are protected by the ‘triple lock’, meaning the amount paid is increased every year in line with inflation, average earnings or 2.5% - whichever is highest. While the Consumer Prices Index (CPI) inflation measure for September was 1.7%, average earnings increased by 3.9% in the three months leading up to July, so this figure will be used.

TIP - from 1 June 2020, people over 75 who are not in receipt of Pension Credit will need to start paying over £150 per year for a TV Licence. To find out if you are eligible for Pension Credit, or if you would like us to help you with your claim, please contact us on 01592 721 917.

If you are an Ore Valley Housing Association tenant you will receive a letter in the post explaining the proposed rent increase and a questionnaire to fill out and return to us. We want to hear your views on our proposed rent increase options so please complete and return the questionnaire using the prepaid envelope provided no later than Monday 10th February 2020.

.png)